missouri employer payroll tax calculator

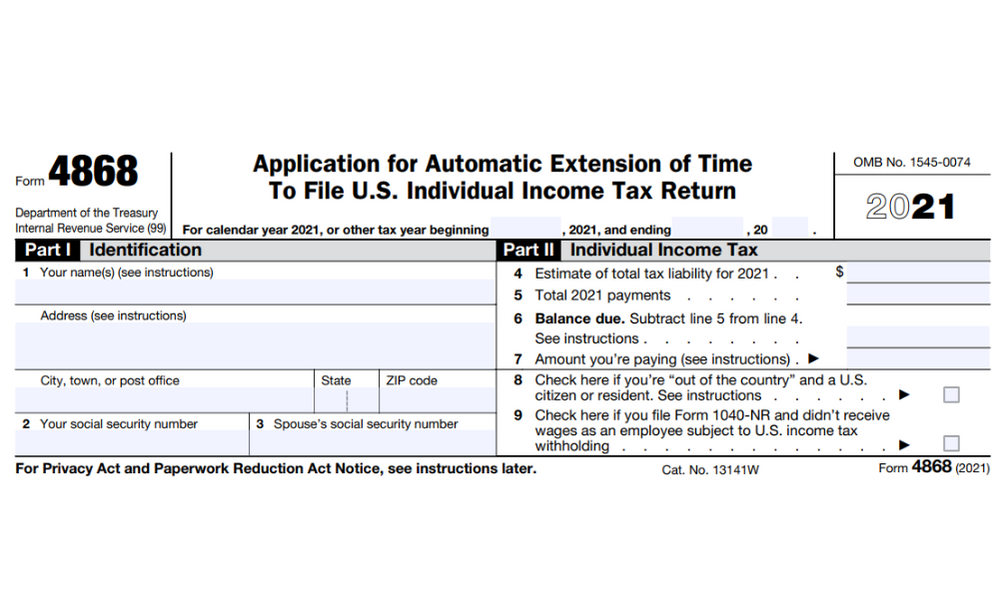

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Working From Home Filing Your 2021 Taxes Will Be Different Td Stories

Work out your adjusted gross.

. Get Started With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

All corporations and manufacturers doing business in the state. It is not a substitute for the advice of. Get Started With ADP Payroll.

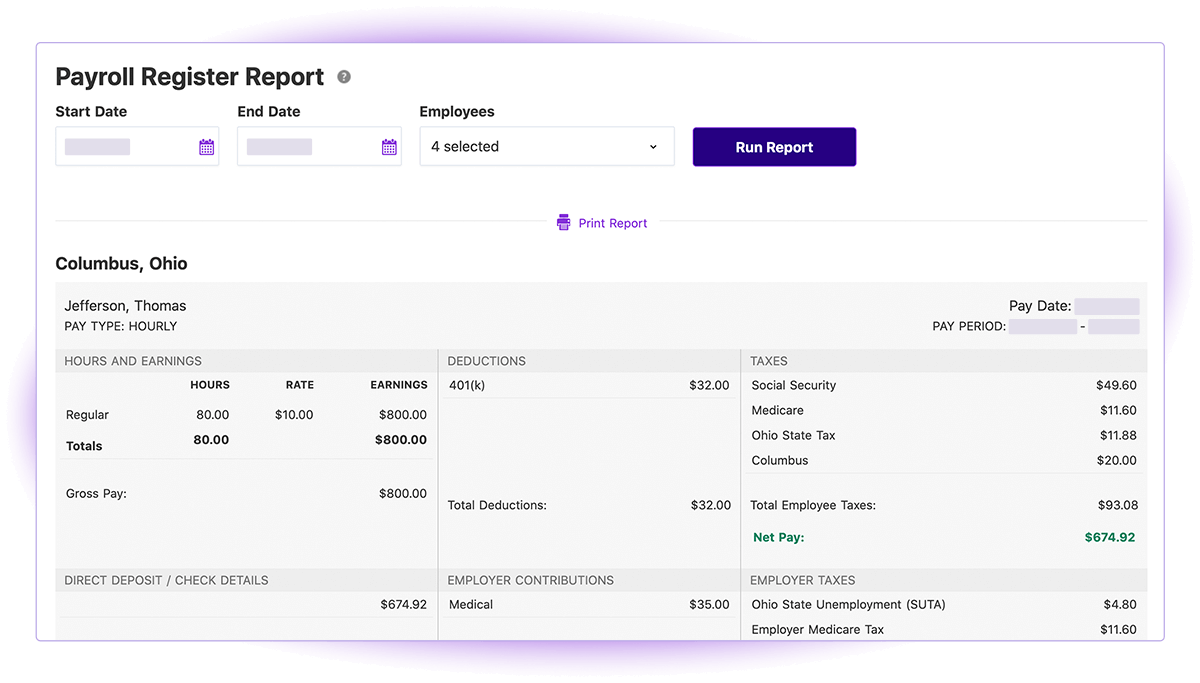

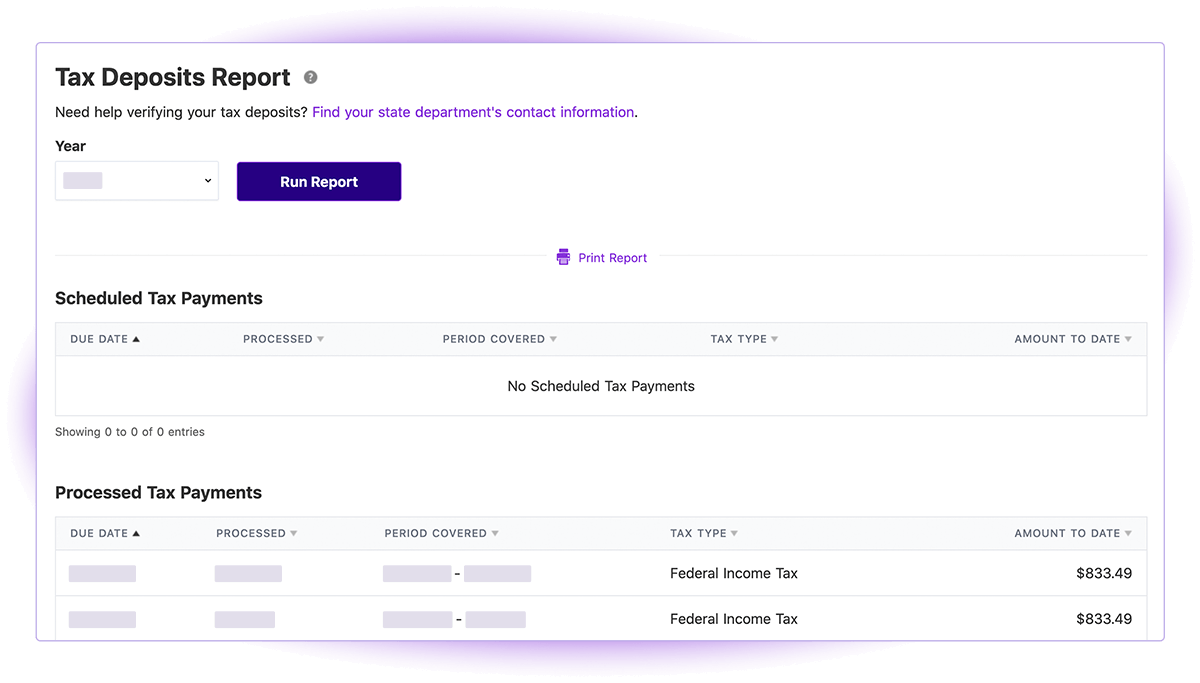

Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. Global salary benchmark and benefit data. Missouri Hourly Paycheck Calculator.

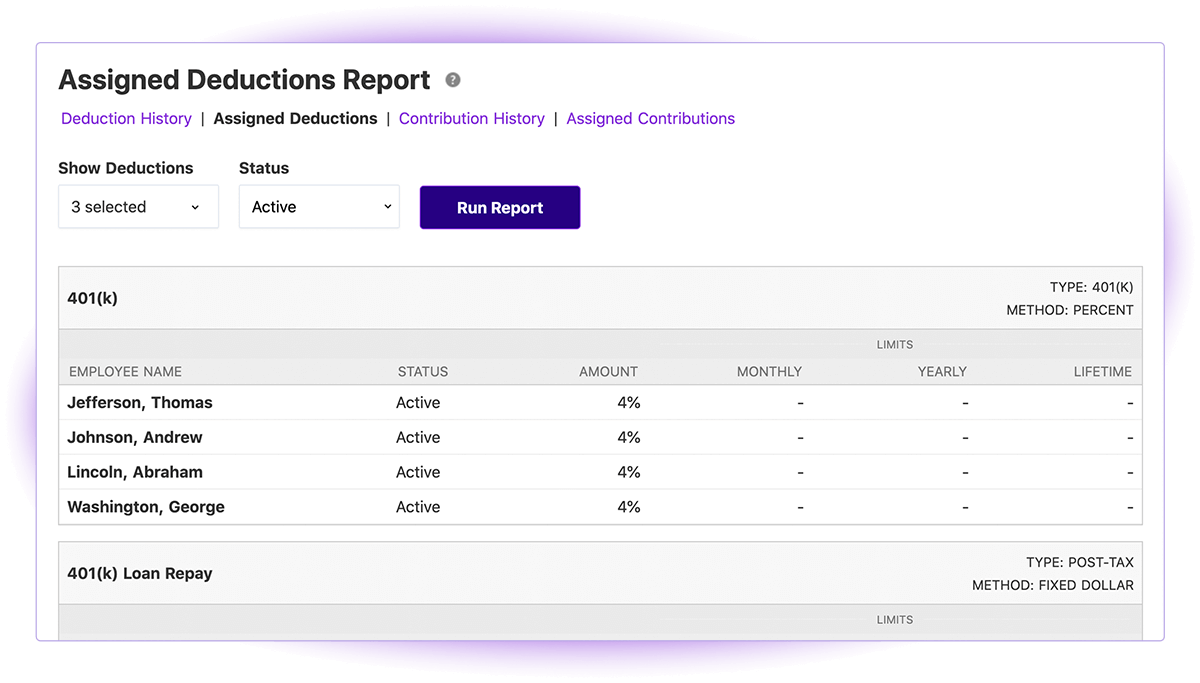

Discover ADP Payroll Benefits Insurance Time Talent HR More. Make sure you are locally compliant with Papaya Global help. Employers can use the calculator rather than manually looking up.

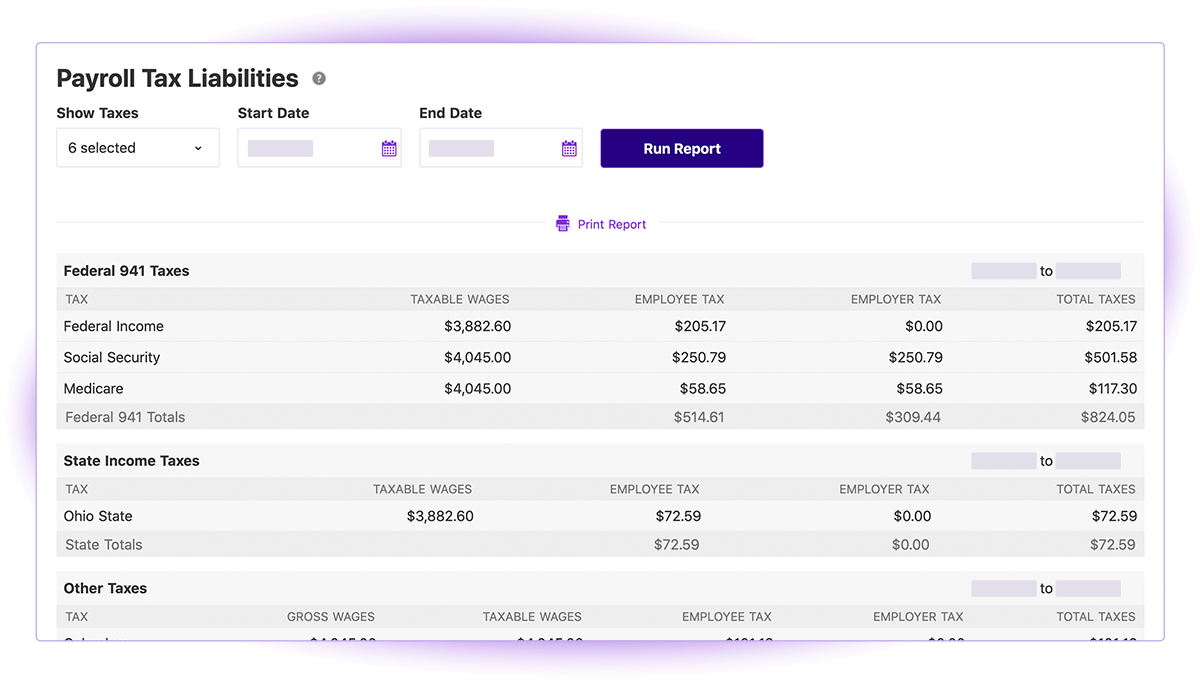

Taxes to withhold Your Missouri State Taxes to withhold are Need to adjust your withholding amount. The Payroll Expense Tax is a 05 tax paid by the employer for wages earned in. Missouri is currently not a credit reduction state.

Complete an updated MO W-4 and submit to your employer. Ad Process Payroll Faster Easier With ADP Payroll. Missouri allows employers to credit up to 430 in earned tips against an employees wages per hour which can result in a cash wage as low as 430 per hour.

Missouri Salary Paycheck Calculator. Global salary benchmark and benefit data. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

An employer can use the calculator to compute and prepare paychecks. Ad Process Payroll Faster Easier With ADP Payroll. Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri.

City resident employers must withhold earnings taxes on all employees regardless of employee work location. Discover ADP Payroll Benefits Insurance Time Talent HR More. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security DES information on the wages of their covered employees each. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Number of Qualifying Children under Age 17.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only. Our paycheck calculator for employers makes the payroll process a breeze.

All Services Backed by Tax Guarantee. Ad Payroll Employment Law for 160 Countries. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Important note on the salary paycheck calculator. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated. Make sure you are locally compliant with Papaya Global help.

Additions to Tax and Interest Calculator. The standard FUTA tax rate is 6 so your max. Ad Payroll Employment Law for 160 Countries.

An employee can use the calculator to compare net pay with different number of allowances marital status or income. Choose Marital Status Single or Dual Income Married Married one income Head of Household. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Employees with multiple employers may refer to. Missouri Payroll for Employers.

Withhold 62 of each employees taxable wages until they earn gross pay. Check if you have multiple jobs. Employers covered by Missouris wage payment law must pay wages at least semi-monthly.

Online Payroll For Small Business Patriot Software

Procus Yakuza No Drag Hardshell Motorcycle Backpack Anti Theft Usb Port Smart Laptop Backpack Stealth Black Patent Pending Laptop Hp Products Hdd

What Parents Who Have A Child With Cerebral Palsy Should Know Before Filing Taxes Tax Preparation Business Tax Business Advisor

Online Payroll For Small Business Patriot Software

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Is The Bonus Tax Rate For 2022 Hourly Inc

2022 Tax Inflation Adjustments Released By Irs

Understanding The Difference Between P45 P60 Payslips Online Tax Forms National Insurance Number Income Tax

Online Payroll For Small Business Patriot Software

Construction Accounting Software For Contractors Quickbooks

2022 Tax Inflation Adjustments Released By Irs

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Corporate Taxation The Magical Dividend Refund Canadian Portfolio Manager Blog

Irs Gives Tax Break To Sexual Harassment Victims

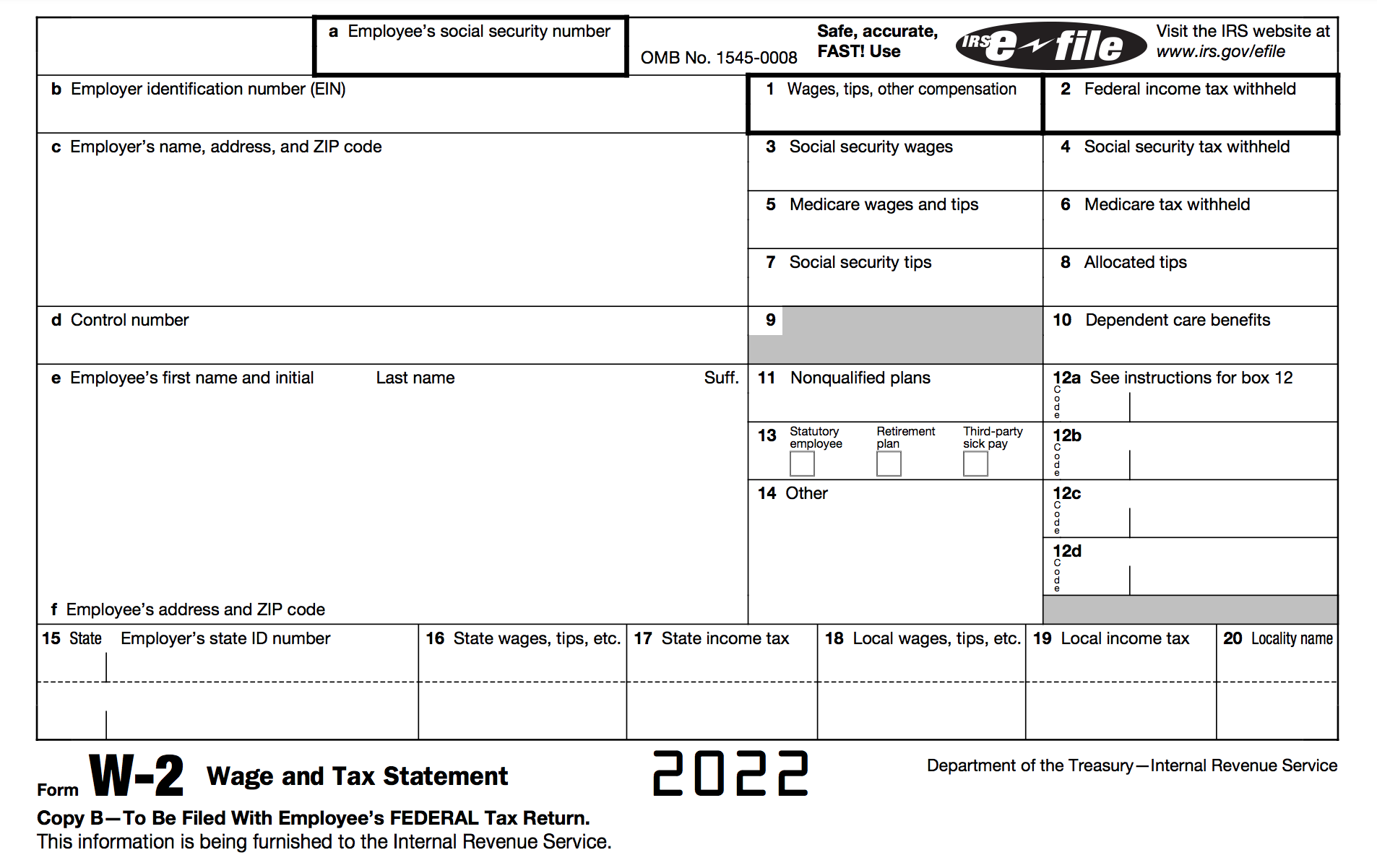

How To Fill Out A W 2 Tax Form For Employees Smartasset

Online Payroll For Small Business Patriot Software

Corporate Taxation The Magical Dividend Refund Canadian Portfolio Manager Blog

Procus Yakuza No Drag Hardshell Motorcycle Backpack Anti Theft Usb Port Smart Laptop Backpack Stealth Black Patent Pending Laptop Hp Products Hdd